TLDR version: Promote business, trade, production of goods and competition

Long version:

In a way, today's inflation is one of the signs of the Hour.

" ... the increase of wealth to such an extent that even if one is given one hundred Dinars, he will not be satisfied ..." Said our Prophet Muhammad (pbuh), and it certainly applies today.

It is well known that Islam bans interest, and early Islamic empires (in fact, generally up to the Ottomans in the 14th century) faithfully followed this doctrine. There were no small kingdoms - the Ummayyad Empire was the largest empire in history at the time of its existence, stretching from Spain to the borders of India. With such complex trade routes, variety of products and constant warfare, inflation was always a possibility. How did these governments deal with inflation, when there is no interest rate to raise?

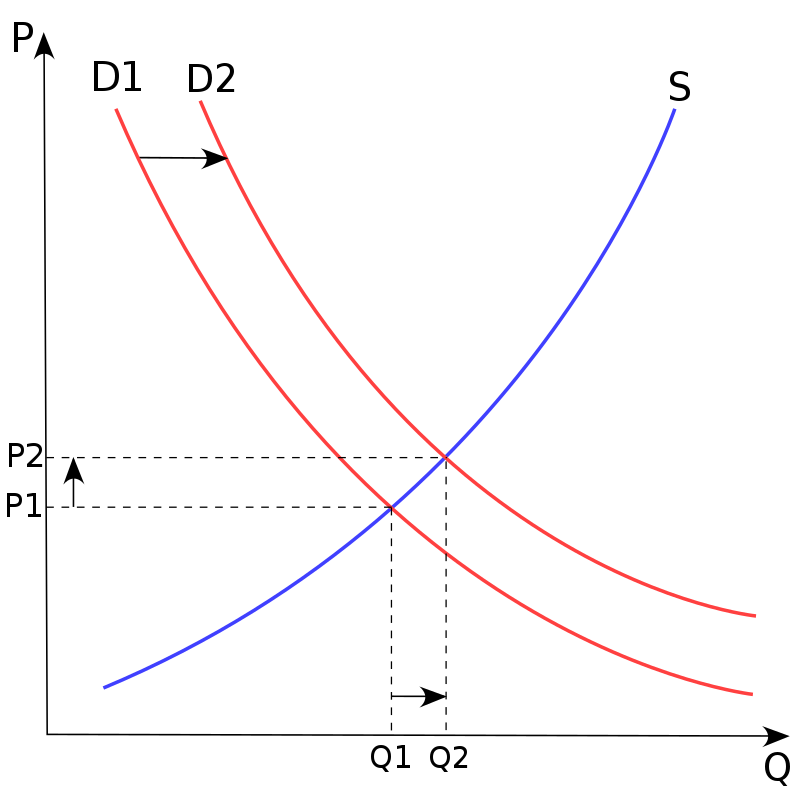

What causes inflation? Inflation is caused either by having surplus means of payments (including higher quantity of money in a society) or shortage of general supply. In other words, it deals with supply and demand, but in a general matter that touches all goods and services in economy.

This is how Islamic governments dealt with inflation:

1. No price fixing.

Inflation happened during the time of Prophet Muhammad (pbuh). During the second year of Hijrah, prices rose and people wanted him to fix the prices. He refused [1].

2. Emphasize trade, and zero interest

“Whereas Allah has permitted trading and forbidden Riba (interet) ”(excerpt from; Surah Baqarah, 2-275).

Trading is real economic activity. In light of the above verse, Allah is emphasizing on trading or productivity, while Riba or interest has been made forbidden. Islamic governments encouraged trade, facilitated trade, and reduced barriers to entry for trade. As per Islamic philosophy, the use of ‘interest’, only helps rich or capitalists to multiply and control the wealth, which has specifically been referred in; Al-Quran 3-130.

No interest also meant far less credit available for investors for risky ventures that could result in big losses.

3. Preventing monopolies and hoarding

Monopolies, by their nature, lead to lack of competition through inhibiting innovation and quality, generally causing harm by driving prices upwards through restricting supply and leading to injustice. The Prophet Muhammad pbuh clearly criticised this [2]. He prohibited hoarding (one person buying up all the supplies to drive up demand).

4. Zakat and Awqaf

All Muslims (and their incorporated businesses in today's world) will have to pay zakat. Roughly this is 2.5% of all the savings (separate calculations are there for farm stock and cattle and gold/silver). Thus there was a natural incentive not to store money, but invest in business.

Zakat being applied on the sale price acts to disincentivize artificially pushing prices up as a natural consequence, since increased prices of stock held would mean an increase in the amount of money required to pay the zakat.

Awqāf (Arabic for endowments, singular waqf) are a special kind of philanthropic deed in perpetuity, involving the donation of a sustainable asset that can produce a financial return or benefit, which then serves specific beneficiaries. The beauty of awqāf is its unrestricted nature vis-a-vis zakāh. Since awqāf utilise capital investment and then distribute the income/produce generated for social benefit, they can be set up to provide for the basic needs of people.

5. Government action on protectionism, and on supply and demand

While the Islamic government could not fix prices (and does not have any interest rate to manipulate), they would act both to protect the domestic economy as well as take action when there is a shortage of certain goods in the market. For example, Prophet Muhammad (pbuh) created a separate market place for the nascent Muslim community in his very first year, enabling them to trade with each other without relying on other communities. He also prohibited a local city dweller from acting as an agent for a visitor, so cutting down the middleman.

Similarly, in the famine year, which was called Ramadha (ashes) year, when famine occurred only in Hijaz due to food shortage in that year and thus food prices increased, Caliph ‘Umar ibn Al-Khattab did not fix the prices of the foodstuffs. Rather he ordered supplies of foodstuffs from Egypt and ash-Sham to be sent to the Hijaz; thus prices dropped without the need for pricing.

It should also be noted that early Islamic empires (especially the Rashidun Caliphate) had a type of minimum wage (established under Caliph Umar where if the salary given to a slave was less than what he needed to live, the master would be punished for any crime committed by the slave to satisfy his hunger ), a type of guaranteed income (Caliph Abu Bakr would give essentials such as grain, blankets etc. to citizens), as well as a stipend for some notable members of the community.

In conclusion:

Under an Islamic economy, goods and services would be subject to natural market conditions, being driven by supply and demand in their purest sense, without interest-based credit distorting every level of the supply chain. Whilst Islam promotes a laissez-faire approach to market regulation, placing no prohibition on growth or price controls, it balances this with intervention by protecting the fundamentals required to live (such as staple foods and by extension utilities) under extreme circumstances to protect the consumer from being taken advantage of.

References:

1.

Imam Ahmad narrated from Anas who said: “Prices increased at the time of the Messenger of Allah (pbuh), so they said, O Messenger of Allah, we wish would you price (fix the prices). He (pbuh) said: “Indeed Allah is the Creator, the holder (Qabidh), the Open-handed (Basit), the Provider (Raziq), the Pricer (who fixes prices); and I wish I will meet Allah and nobody demands (complains) of me for unjust act I did against him, neither in blood or property.”

Also Abu Dawud narrated from Abu Huraira, He said, “A man came and said, O Messenger of Allah, fix prices. He (pbuh) said: “Rather Allah reduces and increases.”

2.

“Whoever withholds food [in order to raise its price] has certainly erred!"

“Whoever strives to increase the cost [of products] for Muslims, Allah, the Exalted, will seat him in the centre of the Fire on the Day of Resurrection."

“What an evil person is the one who withholds! If Allah causes the prices to drop, he would be saddened, and if He causes them to climb, he would be excited."

https://iceurope.org/10-ways-to-manage-the-current-inflation-crisis-an-islamic-perspective/

No comments:

Post a Comment